Today is all about tokenomics. A few weeks ago, Packy collated a bunch of really good resources for understanding the fundamentals of tokenomics and today’s post is a breakdown / note to self on the top pick - Nat Eliason’s Tokenomics 101.

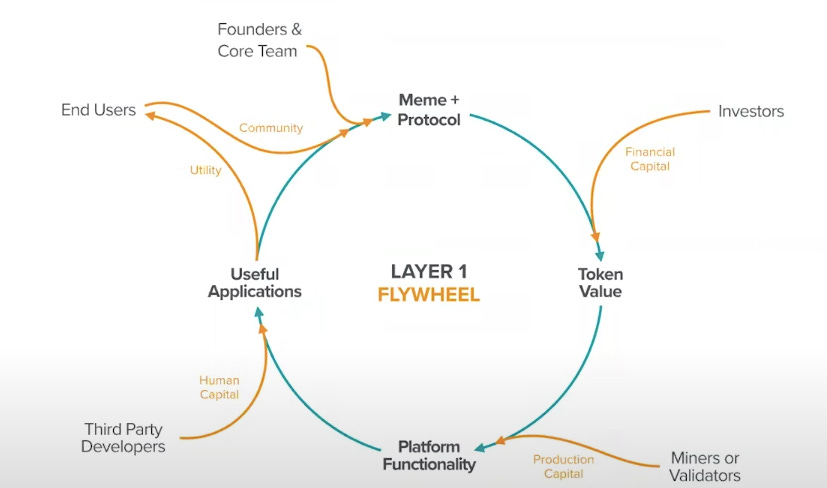

Many many weeks ago, we saw how value is captured across the web3 stack and we learnt how tokens are integral to making the layer 1 flywheel work:

A founding team comes up with an idea for a cool protocol and generates some initial token value with the help of some developers and maybe some investors. Miners and validators allocate computational resources to provide this network with security and functionality. This attracts other third party developers who build more useful applications on top of this protocol. Based on the utility of these applications, a community now reinforces the original vision of the protocol and now we have a positive feedback loop. Given how central tokens are to this entire flywheel, poor tokenomics are a recipe for failure. So today we will look at how we can evaluate the tokenomics of new projects, lets jump right in!

Just like normal economics, the two forces of concern are supply and demand. Understanding supply and demand drivers for the token in question gives a clear picture of how desirable it should be.

Starting with supply, it is important to understand if the value of the token would remain stable / increase / be inflated away based on its supply. Without getting into the utility of the token at this point, it is important to understand how many tokens exist currently, how many will ever exist and how quickly are new tokens being released. Very simply, more tokens mean lesser value and lesser tokens mean more value. Allocation is another parameter to consider. Are a large number of tokens held by a handful of investors? how fair does the distribution seem?

Supply is not the only factor that determines token value as seen from examples like Olympus DAO which has prints huge amounts of OHM tokens everyday but is not necessarily a bad bet. Enter demand.

Scarcity alone does not create value. A community of people need to believe something has value and would continue to have value. Nat argues that we need to look at RoI, memes and game theory to understand token demand. Lets start with RoI.

RoI is not how much the token value would appreciate in the future but it is a measure of how much cash flow could be generated just by holding it. Holding and staking ether for example, can get you paid in ETH at like 5% once proof of stake kicks in. The reason Olympus’ heavy inflation is not a bad thing is because of what’s called ‘rebasing’. It is when by holding a token and staking it, you get more of it as the protocol inflates. So if a token has no intrinsic RoI or cash flows, it is hard to justify it value.

Memes: Another demand driver for tokens is when people believe that other people would want the token and continue to want it well into the future.

You can call it faith, conviction, or memes, but, whatever you call it, the machine that generates belief in the growth of future value is always going to be an important consideration.

Memes are fuzzy and not easily measurable so the only way to understand the ‘meme potential’ of a project is by being a part of the community and getting a feel for its energy. Bitcoin is the biggest example of this metric - it has no cash flows, no staking rewards etc., just the belief that it could be a long term store of value.

Moving on to the third demand element: game theory. This is where things get a bit more complex as we have seen before with mechanism design and everything but lets look at one good example - lockups.

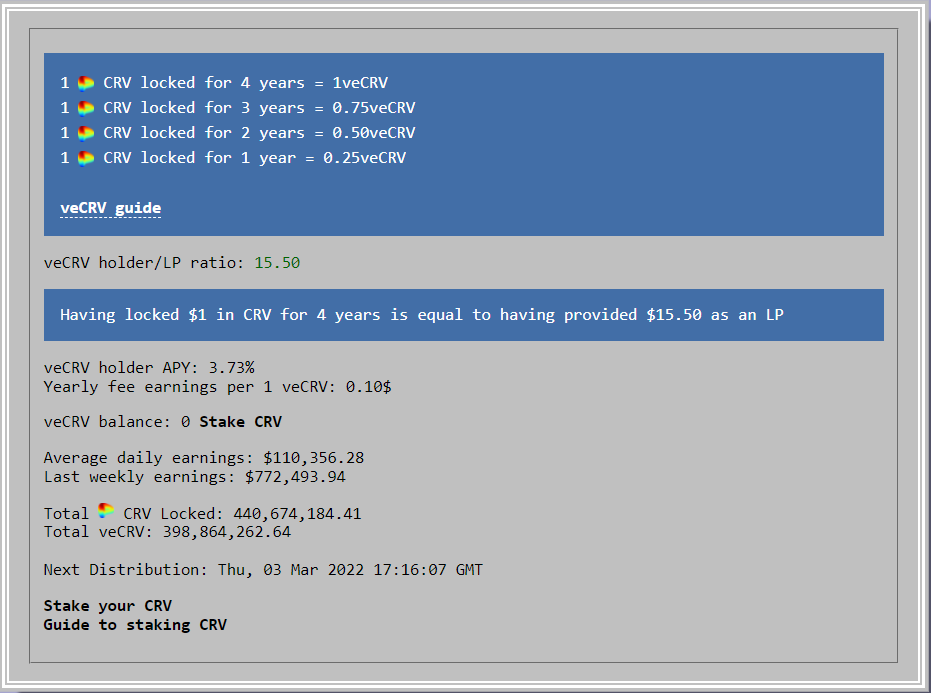

Lockups are when a protocol creates incentives for locking your tokens in a contract for greater rewards. Curve is the perfect example for this. Curve lets you lock CRV tokens in exchange for a share of the protocol revenue. The longer you lock your tokens, the greater the reward. Locking more tokens for a longer period of time also lets you use other parts of Curve for lower fees.

To summarize, there’s Supply: Inflation, Token Distribution and Emission(rate at which tokens are released) and Demand: RoI, Memes and Game Theory. So the next time you come across a shiny new project that promises the world to you, you know all the right questions to ask before jumping right in!